Charlotte|Winston Salem – What could the US changing housing market mean for investors?

Sharp Increases In Rent Expected in 2023

Helpful Info From Your Local Carolina Living Real Estate Expert !

#huntersvillerealestate #winstonsalemrealestate #northcarolinarealestate #charlotterealestate #cltrealestate #charlotterealtor #ncrealtor #ncrealtors #clthomes #charlottehomes

Charlotte|Lake Norman|Winston Salem | 2022 Housing Market Forecast [INFOGRAPHIC]

Carolina Living Real Estate Can Help With All your Housing Needs

![2022 Housing Market Forecast [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/05/05130426/20220506-MEM-1046x1885.png)

Some Highlights

- What does the rest of the year hold for the housing market? Here’s what experts have to say about what lies ahead.

- Home prices are projected to rise and so are mortgage rates. Experts are also forecasting another strong year for home sales as people move to meet their changing needs.

- Let’s connect so you can make your best move this year.

Investors | Will The BRRRR Cycle Work For You?

Carolina Living Real Estate Can Help You with All Your Real Estate Needs

Information is curtesy of AllPropertyManagement

The BRRRR method seems, at first glance, to be a loud declaration of chilliness. But no, it’s not about being cold or needing an extra sweater.

BRRRR stands for Buy, Rehab, Rent, Refinance, Repeat. It’s a type of real estate investment that helps you grow your investment and purchasing power over time, through a cycle of buying, improving, and renting out property to generate passive income.

This article will show you the BRRRR method in action, walk through each step in the cycle, and reveal ways to make the process easier if you’re new to this style of investment. Let’s jump in.

The BRRRR Cycle, Explained

An example: Sally buys a property in Dallas that’s in need of a little TLC. She purchases the home for $150,000 with a 20% downpayment of $30,000, then gets a loan for the additional $120,000.

Next, she applies $40,000 of renovations to the property, hoping that these upgrades will double the value of the original purchase.

After renovations are complete, Sally has her property re-appraised at $300,000 (Well done, Sally!) and is able to rent it out for $2,500 a month. After a couple of years of collecting passive income on the property, Sally is ready to repeat the process.

She takes out another loan for $200,000 (a fraction of the value of her current property), uses it to pay off the original loan of $120,000, and begins the process again with a start-up fund of $80,000 PLUS her ongoing passive rental income.

Of course, Sally’s experience is the simplest version available. The actual application of the BRRRR method requires a bit more elbow grease.

Read the rest of the article at AllPropertyManagement

Is US Housing Bubble Brewing?

Carolina Living Real Estate Can Assist You with All Your Real Estate Needs

We are client focused whether you are an investor, Home Buyer or Home Seller!

Thinking of Buying? Using Your Tax Refund To Achieve Your Homeownership Goals This Year

Let Carolina Living Real Estate Help You Get Started

If you’re buying or selling a home this year, you’re likely saving up for a variety of expenses. For buyers, that might include things like your down payment and closing costs. And for sellers, you’re probably working on a bit of spring cleaning and maintenance to spruce up your house before you list it.

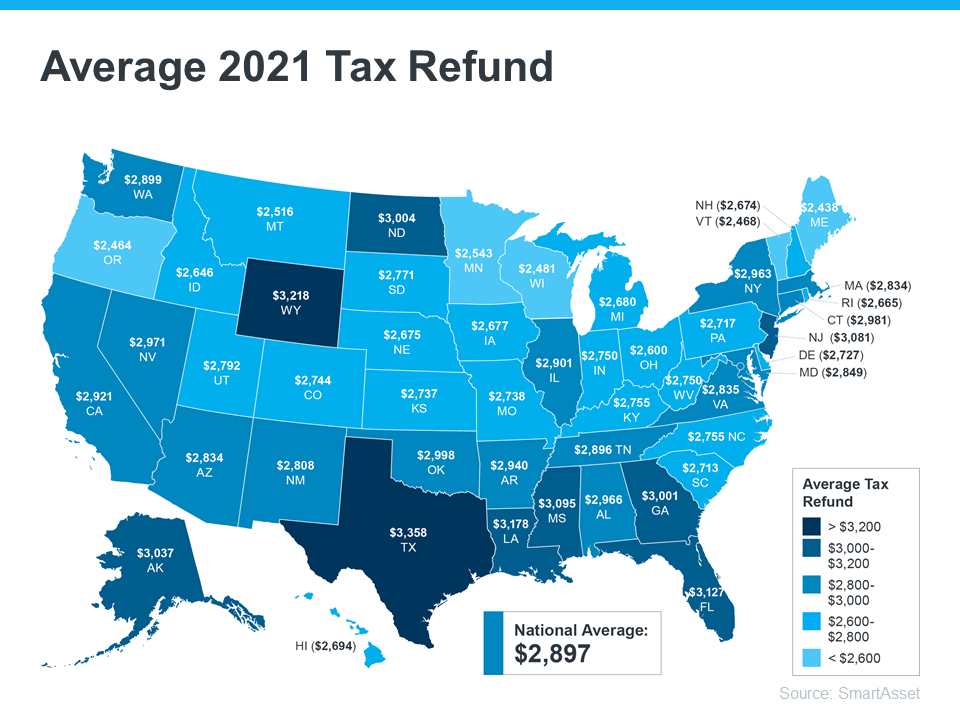

Either way, any money you get back from your taxes can help you achieve your goals. Using a tax refund is a common tactic for buyers and sellers. SmartAsset estimates the average American will receive a $2,897 tax refund this year. The map below provides a more detailed estimate by state:

If you’re getting a refund this year, here are a few tips to help with your home purchase or sale this season.

How Buyers Can Use Their Tax Refund

According to American Financing, there are multiple ways your refund check can help you as a homebuyer. A few include:

- Growing your down payment fund – If you haven’t started saving for your down payment, let your tax refund kick off the process. And if you have a fund already, the money you get back could put you closer to your goal.

- Paying for your home inspection – Your home inspection can save you a lot of headaches down the road by helping you determine the condition of the house. As a buyer, you’ll typically be responsible for paying for your inspection, and it’s definitely worth the investment.

- Saving for closing costs – Closing costs are additional expenses you’ll need to pay once it’s time to close. They average anywhere between 2-5% of the purchase price of your home.

This list is a great start, but it isn’t exhaustive of all the costs you may encounter as you set out on your homebuying journey. The best way to prepare is to work with a trusted real estate professional to make sure you understand what’s to come in the process.

How Sellers Can Use Their Tax Refund

If you own a home and are planning to sell this spring, your tax refund can help you make sure your home is ready to list. Here are a few ways current homeowners can put their tax refund to good use:

- Making small upgrades – NerdWallet provides a list of great ways to use your tax refund, including tackling small projects or boosting your curb appeal to help your home stand out.

- Making repairs – If there’s anything in your house that needs to be fixed, American Financing notes that completing repairs is another great use of that money.

- Buying your next home – Whether you’re selling to move up or downsize, you can use your tax refund to help pay for any costs on the purchase of your next home.

Of course, it’s important to talk with your trusted real estate advisor before taking on any projects. They’ll make sure you can focus on areas that’ll help you receive the best possible price when you sell.

Bottom Line

Funding your home purchase or sale can feel like a daunting task, but it doesn’t have to be. Your tax refund can help you reach your goals. Let’s connect to discuss how you can start on your journey.

Charlotte|Lake Norman|Winston Salem An Expert Advisor Will Give You the Best Advice in Today’s Market

Carolina Living Real Estate Can Guide You Through Every Scenario

Having an experienced guide coaching you through the process of buying or selling a home is important in a normal market – but today’s market is far from normal. As a result, an expert real estate advisor isn’t just good to have by your side, they’re essential.

Today’s housing market is full of extremes. Experts project mortgage rates will continue to rise this year, and that’s driving significant demand for homes as buyers want to make their purchases before rates climb even higher. At the same time, an absence of sellers is leading to record-low housing inventory. This imbalance in supply and demand is creating bidding wars and driving home price appreciation as well as considerable gains in home equity.

These market conditions can feel overwhelming, but you don’t have to go at it alone. Having a trusted expert to coach you through the process of buying or selling a home gives you clarity and confidence through each step.

Here are just a few of the ways a real estate expert is invaluable:

Contracts – Agents help with the disclosures and contracts necessary in today’s heavily regulated environment.

Experience – In an unprecedented market, experience is crucial. Real estate professionals know the entire sales process, including how it’s changed over the past two years.

Negotiations – Your real estate advisor acts as a buffer in negotiations with all parties throughout the entire transaction and advocates for your best interests.

Education – Knowledge is power in today’s market, and your advisor will simply and effectively explain market conditions and translate what they mean for you.

Pricing – Finally, a real estate professional understands today’s real estate values when setting the price of your home or helping you make an offer to purchase one.

A real estate agent is a crucial guide through this unprecedented market, but not all agents are created equal. A true expert can carefully walk you through the whole real estate process, look out for your unique needs, and advise you on the best ways to achieve success. Finding an expert real estate advisor – not just any agent – should be your top priority when you’re ready to buy or sell a home.

What’s the key to choosing the right expert?

It starts with trust. You’ll want to know you can trust the advice they’re giving you, so you need to make sure you’re connected with a true professional. No one can provide perfect advice because it’s impossible to know exactly what’s going to happen at every turn – especially in today’s unique market. But a true professional can give you the best possible advice based on the information and situation at hand. They’ll help you make the necessary adjustments along the way, advocate for you throughout the process, and coach you on the essential knowledge you need to make confident decisions. That’s exactly what you want and deserve.

Bottom Line

It’s critical to have an expert on your side who’s well versed in navigating today’s rapidly changing market. If you’re planning to buy or sell a home this year, let’s connect so you have a real estate professional on your side to give you the best advice and guide you along the way.

The Difference Between Renting and Owning

Carolina Living Real Estate and Property Management can assist renters looking to buy,investors looking for investments and/or investors looking to sell.

![The Difference Between Renting and Owning [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/02/24130106/20220225-MEM-1046x2279.png)

Some Highlights

- If you’re deciding whether to rent or buy, consider the many financial benefits that come with owning a home.

- As a renter, you build your landlord’s wealth and face rising costs. As a homeowner, you build your own net worth and can lock in your monthly payments for the length of your loan.

- If you’re weighing your options, remember that owning a home is a decision that has considerable financial perks. If you want to learn more, let’s connect to talk about the perks of homeownership.

Charlotte | Lake Norman Property Management : 4 Things Every Renter Needs To Consider

Carolina Living Real Estate and Property Management

As a renter, you’re constantly faced with the same dilemma: keep renting for another year or purchase a home? Your answer depends on your current situation and future plans, but there are a number of benefits to homeownership every renter needs to consider.

Here are a few things you should think about before you settle on renting for another year.

1. Rents Are Rising Quickly

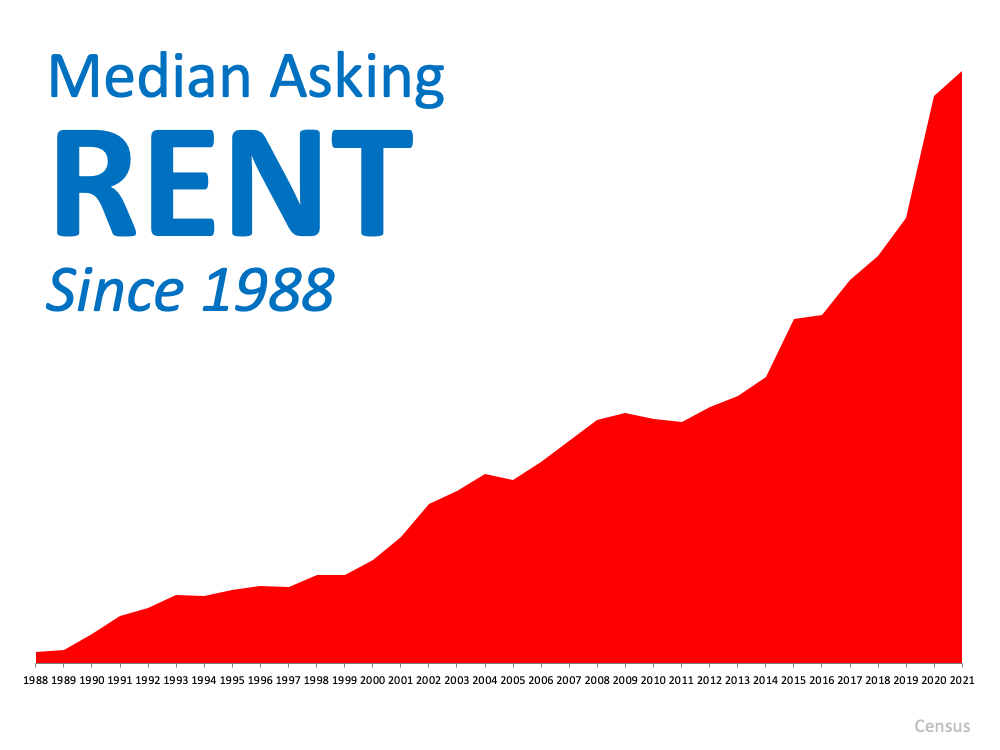

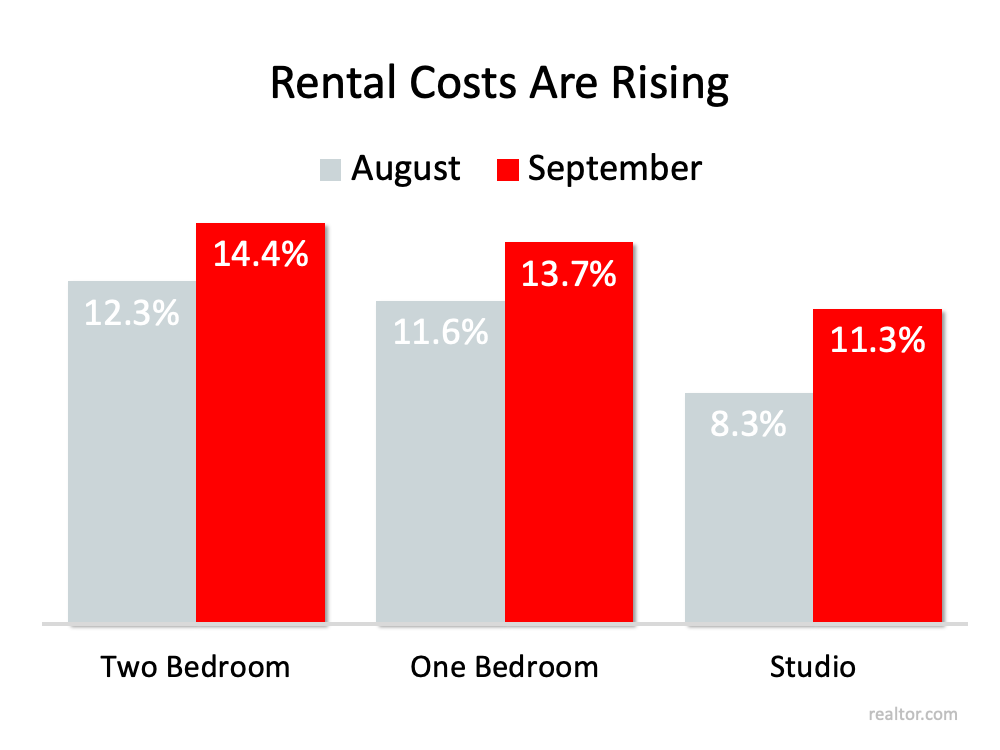

Rent increasing each year isn’t new. Looking back at Census data confirms rental prices have gone up consistently for decades (see graph below): If you’re a renter, you’re faced with payments that continue to climb each year. Realtor.com recently shared the September Rental Report, and it shows price increases accelerating from August to September (see graph below):

If you’re a renter, you’re faced with payments that continue to climb each year. Realtor.com recently shared the September Rental Report, and it shows price increases accelerating from August to September (see graph below): As the graph shows, rents are still on the rise. It’s important to keep this in mind when the time comes for you to sign a new lease, as your monthly rental payment may increase substantially when you do.

As the graph shows, rents are still on the rise. It’s important to keep this in mind when the time comes for you to sign a new lease, as your monthly rental payment may increase substantially when you do.

2. Renters Miss Out on Equity Gains

One of the most significant advantages of buying a home is the wealth you build through equity. This year alone, homeowners gained a substantial amount of equity, which, in turn, grew their net worth. As a renter, you miss out on this wealth-building tool that can be used to fund your retirement, buy a bigger home, downsize, or even achieve personal goals like paying for an education or starting a new business.

3. Homeowners Can Customize to Their Heart’s Content

This is a big decision-making point if you want to be able to paint, renovate, and make home upgrades. In many cases, your property owner determines these selections and prefers you don’t alter them as a renter. As a homeowner, you have the freedom to decorate and personalize your home to truly make it your own.

4. Owning a Home May Provide Greater Mobility than You Think

You may choose to rent because you feel it provides greater flexibility if you need to move for any reason. While it’s true that selling a home may take more time than finding a new rental, it’s important to note how quickly houses are selling in today’s market. According to the National Association of Realtors (NAR), the average home is only on the market for 17 days. That means you may have more flexibility than you think if you need to relocate as a homeowner.

Bottom Line

Deciding if it’s the right time for you to buy is a personal decision, and the timing is different for everyone. However, if you’d like to learn more about the benefits of homeownership, let’s connect so you can make a confident, informed decision and have a trusted advisor along the way.

Tired or Happy about Rising Rents? We Can Help

Carolina Living Real Estate is Well Positioned to Help You with Your real Estate Needs

Rents have risen consistently over the last 30 years, and they’re not showing signs of stopping. Let’s connect today if you’re ready to purchase a home and move on from renting.

For Investors, this is a telling sign for you as well. Let us help you find the right investment property and you can rest assure your ROI will continue to increase. We know how to find the right home in the right area.

Professional Services at reasonable rates

Professional Services at reasonable rates